Hospitality Industry in Emergency Room

How resuscitating a struggling hotel sector can start with language!

Despite the early signs of a struggle looming in the horizon, hotel sector in the Middle East, and hospitality in general, were heading towards a relatively an industry-specific crisis with relation to over-supply in rooms (Homsy 2021) for relatively non-expansive territories. This region was stormed with a number of political unrests in parts of the Middle East, influx of different types of migrations, an extremely competitive market, and the looms of early signs of a broad economic recession (Gasdia and Jackson 2020). Yet, the COVID-19 pandemic comes in to add a kick to a struggling boat in midst of this unprecedented storm. With travel restrictions, financial difficulties, and safety fears, global occupancy rates plummeted drastically with 80% in Europe and 90% in the US (Crouch et al 2020). While the UAE hotel sector was affected at the beginning, signs of rebounds started to vitalise the struggling industry by means of domestic tourism, COVID-19 vaccine roll-out, and having Expo 2020 as big stimulator (Rizvi 2021).

Has the hotel sector supplied too many keys?

But as for any struggling sector, the ability to convey the right message in the right time is key to sustain clientele and business, if not increasing the business revenue. To be able to do so, businesses, and hotels in this case, need to examine and understand the importance of what they offer on their social media platforms and on their websites to customers in order to adapt for a greatly changing travel and tourism climate. Consult Upgrade has the right tools to do so as explored in this article.

METHODOLOGY

Consult Upgrade provide an in-depth linguistic and psychological analysis by harnessing and decoding the language used whether in social media, website, newsletters, campaigns, or any other medium. Consult Upgrade’s main foundation is the fact that one of the keys to a healthy business, is an understanding how language works and manipulating it to yield and return profit, and to achieve business targets.

For this insight, and to provide helpful insights for hotel industry, the Consult Upgrade team examined the language content of two big and major hotel groups that operate in UAE: One is a local luxury hotels and resorts group with 24 branded properties (most of which are in UAE). The other is leading regional hotel group with 80 properties in the Middle East, Africa, and Eastern Europe; 34 of which are properties in the UAE. Consult Upgrade team collected, compiled, and analysed over 740,000 words from the social media streams of those two groups, and the content of their website. To eliminate data redundancy, we analysed the English content and did not include any other language versions.

We applied our own methodology in analysing the data. Consult Upgrade methodology is a set of unique innovative data processes in which we apply quantitative and qualitative analyses technique to the aggregated data, informed and guided by a custom-made pragmatic, linguistic and psycholinguistic coding framework. We look at what the language collected can tell us about the sentiments of content writers, their personal traits, the drives behind their behaviour, and we look at key themes & word frequencies through our bespoke AI powered coding system designed for this particular research.

THE FINDINGS: Introducing Bitter Brat the sweet talker

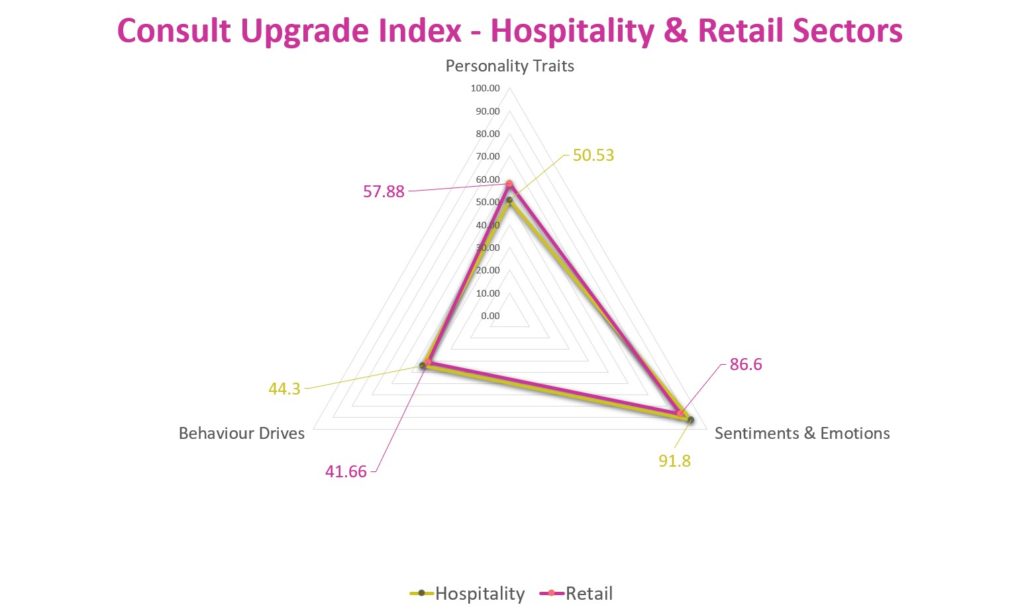

When analysing the content, the two hospitality giants returned quite high scores in emotions and sentiments’ scores overall: both accumulated an outstanding score of 91.9 positive sentiments. To compare it with our previous insight about retail sector in UAE, the below chart shows better score in sentiments, yet lower scores in personality traits and in behaviour drive!

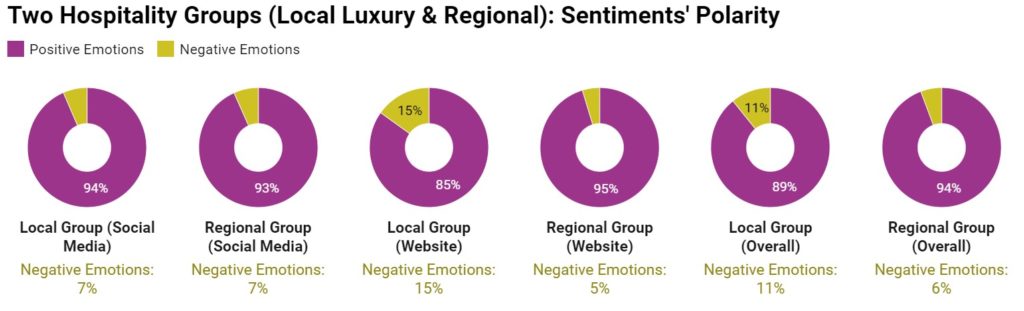

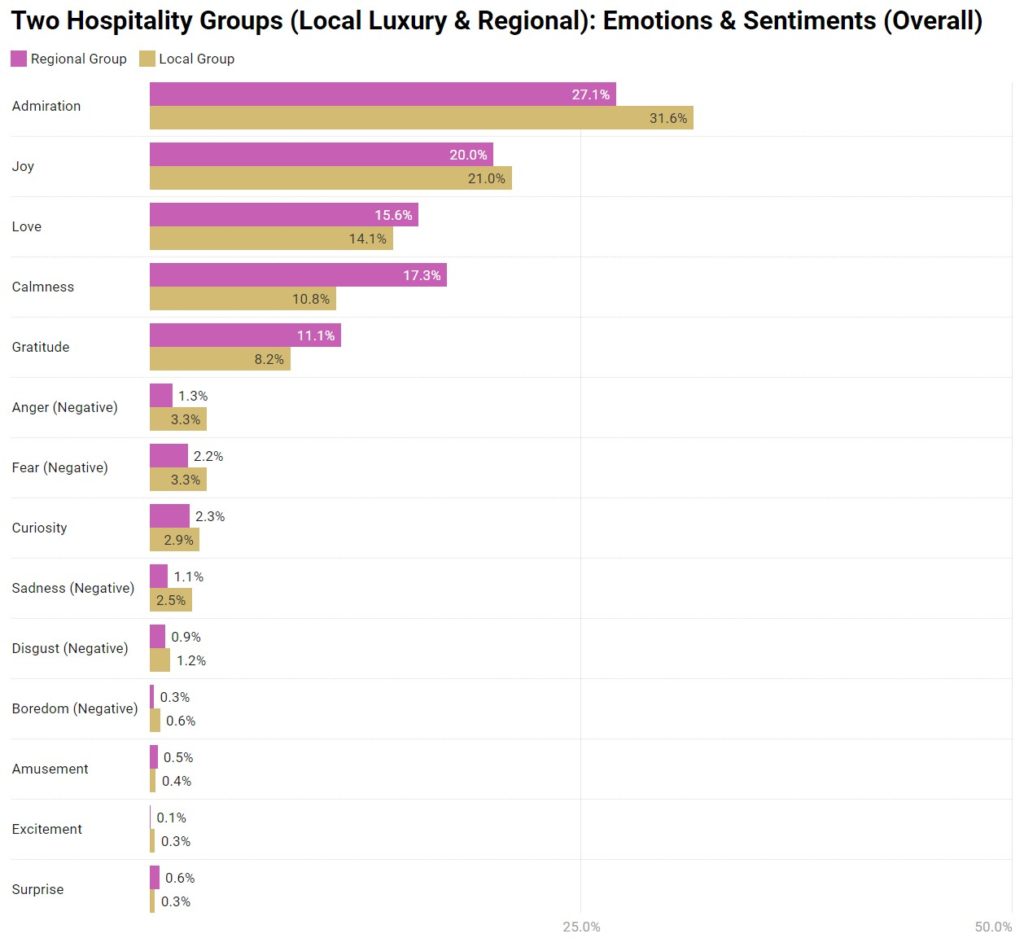

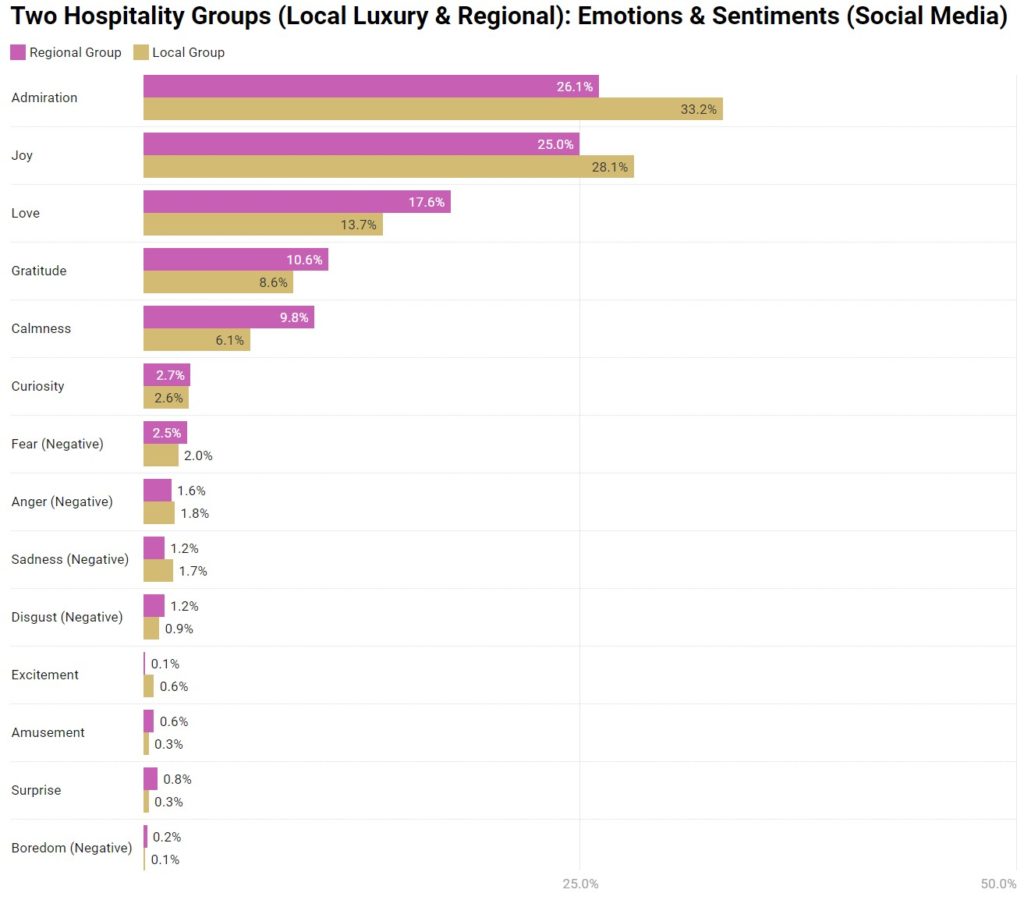

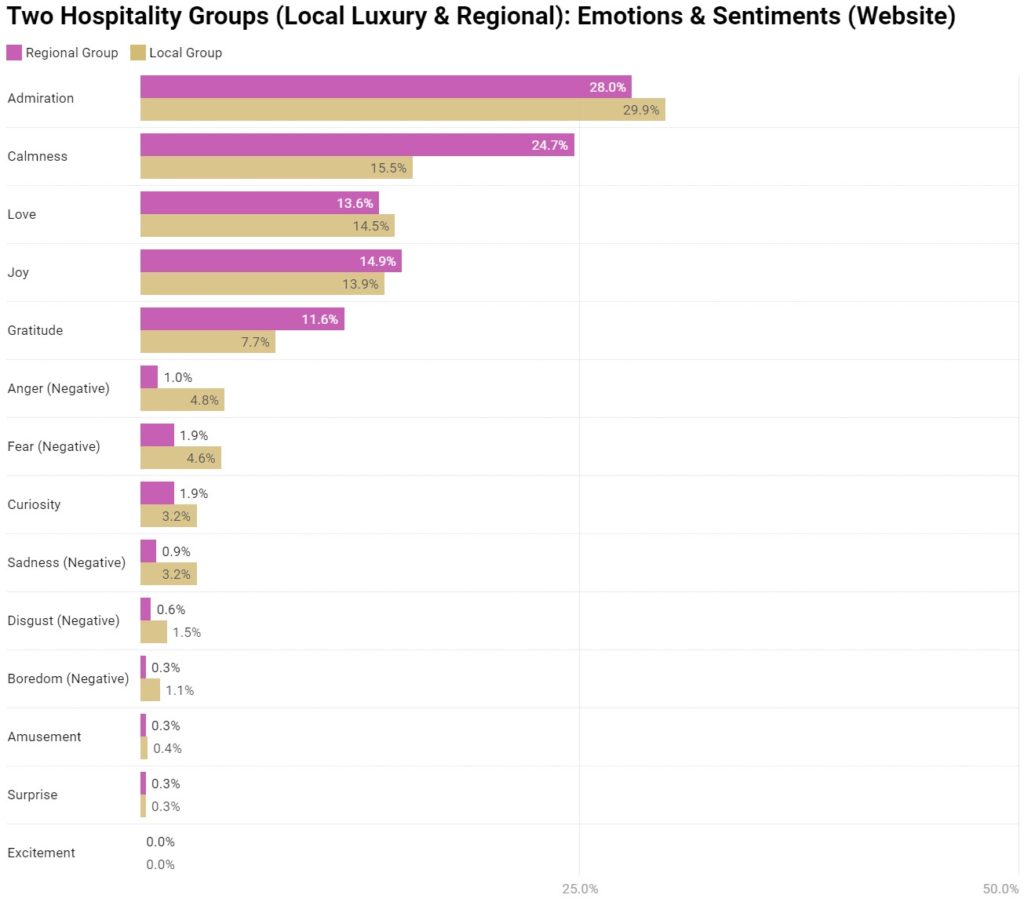

This high score reflects and captures the spirit of the hotel industry which is built on offering convenience and positivity to clients and guests. This was evident in dominating sentiments such as admiration, joy, calmness, and love. However, and despite the fact that the scores in social media content came very similar, the local luxury group’s website came shockingly with negative sentiments comprising 15.2% of website content with anger, fear, and sadness dominating those sentiments: the whole content was quite imbalanced sentiments wise.

THE FINDINGS: Painkillers do not fix a broken backbone!

With the advancement of social media management apps, the focus shift was aimed to manage and manipulate social media content at the expense of websites’. While the utmost thing businesses do is reviewing SEO related parameters, the quality of websites’ content is often neglected and results in an indirect hit for business with the rate of booking-per-visit keeps dropping.

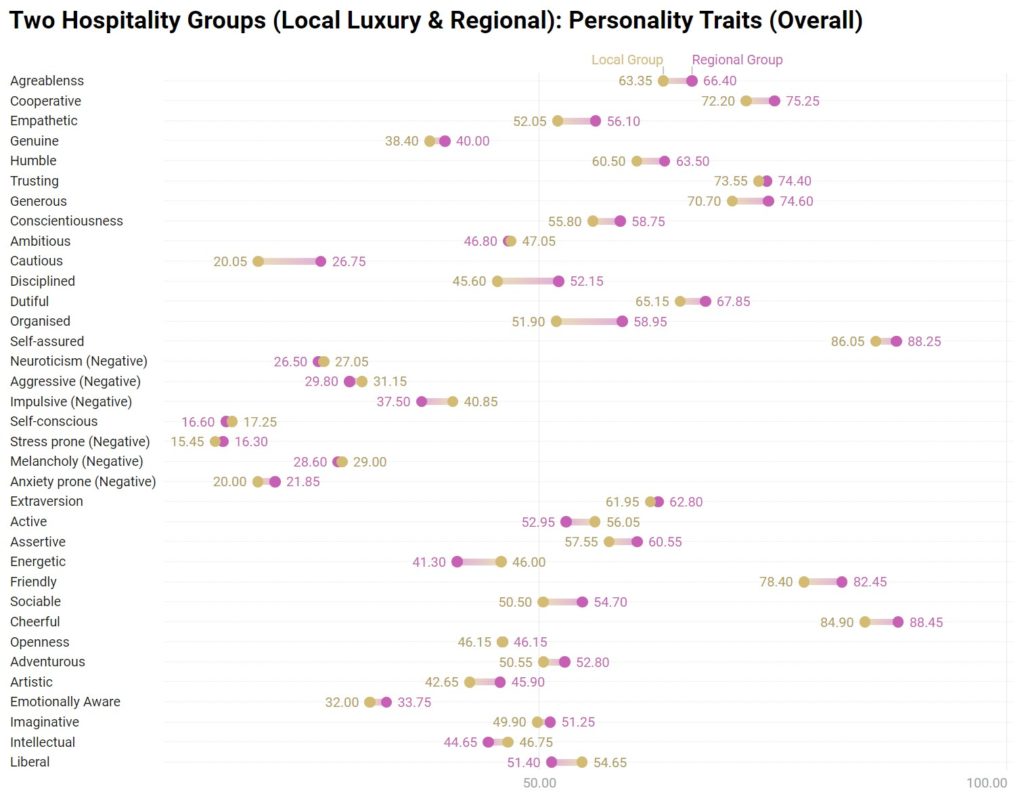

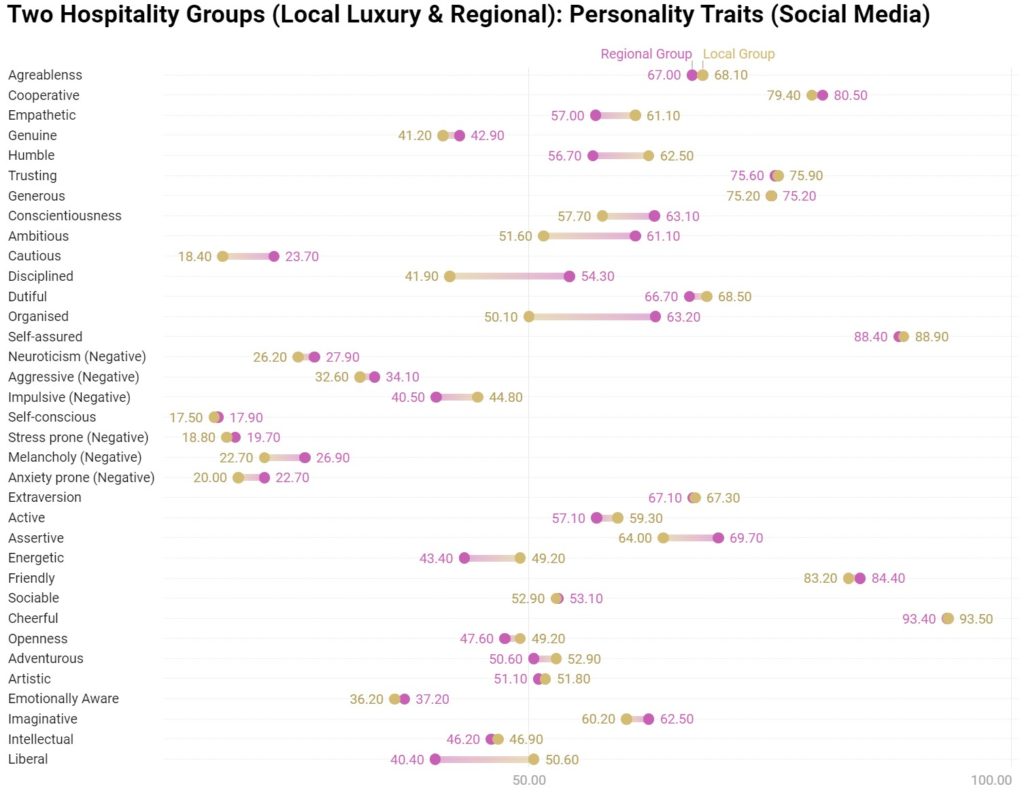

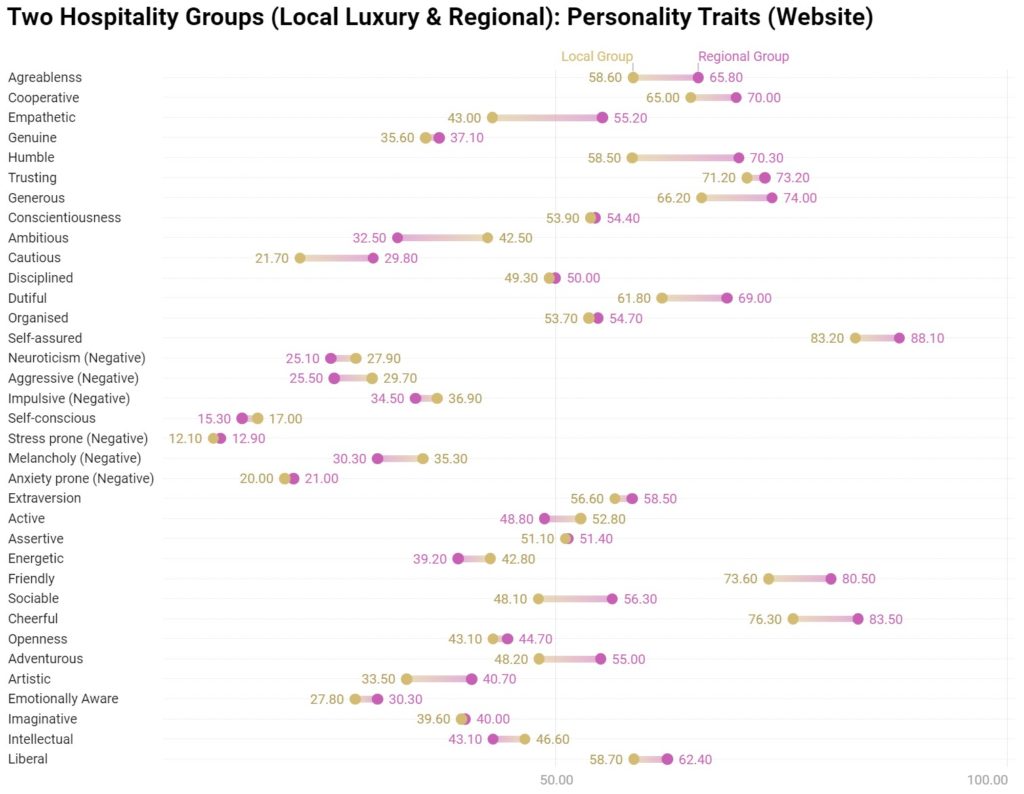

As the team looked at the personality traits of the two groups, the analysis results came with a surprise: anxiety prone and impulsiveness equipped with cautiousness were quite evident in personality traits analysis. Social media content of the local luxury group came balanced with dominating liberal, energetic, and humble traits, yet it showed a 9.6% anger. The regional group on the other hand, returned a whopping 28% in melancholy and anxiety prone traits alone! Nevertheless, in a concordance of some sort with sentiments, the most outstanding shocking result came from the local luxury group’s website content: negative personality traits were so evident with Melancholy 14.16%, Aggressiveness 14.14% and Neuroticism with 10.04%. in an already struggling hotel sector, the website language is key to close the booking. Yet, aggressive traits and neuroticism can sabotage any hotel business, not matter how good the deal is.

THE FINDINGS: Negationectomy is needed

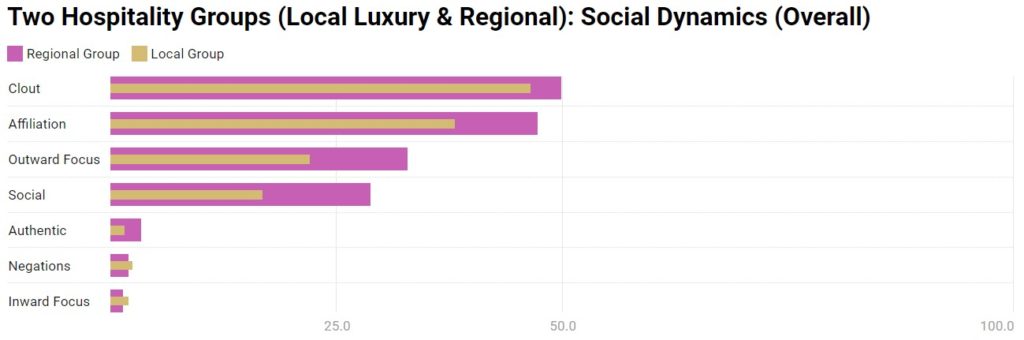

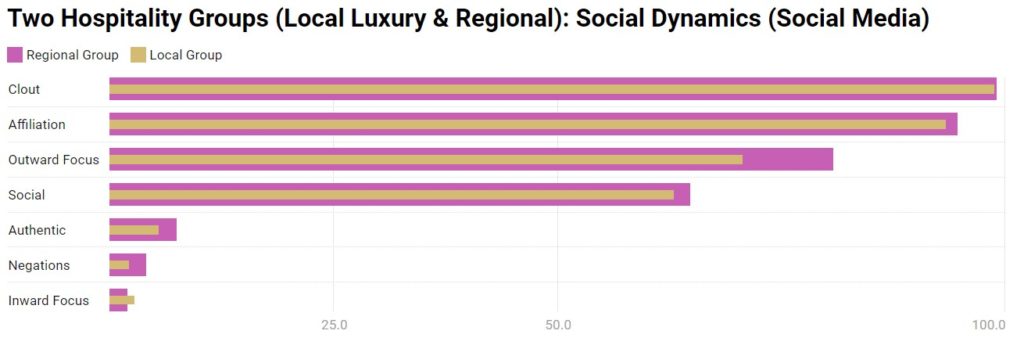

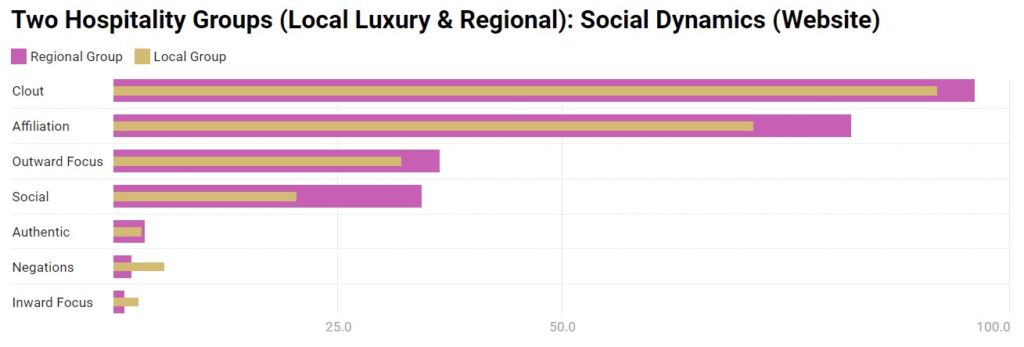

With the analysis went further to pinpoint what was causing the sentimental and personality symptoms, eventually the team managed to point out one of the root causes: hyper use of negation and an inflated inward focus! Surprisingly, both groups came with similar negation issues. With the regional group showed more negation in social media, the local luxury group website’s content came with an increase of negation levels and inward focus in content.

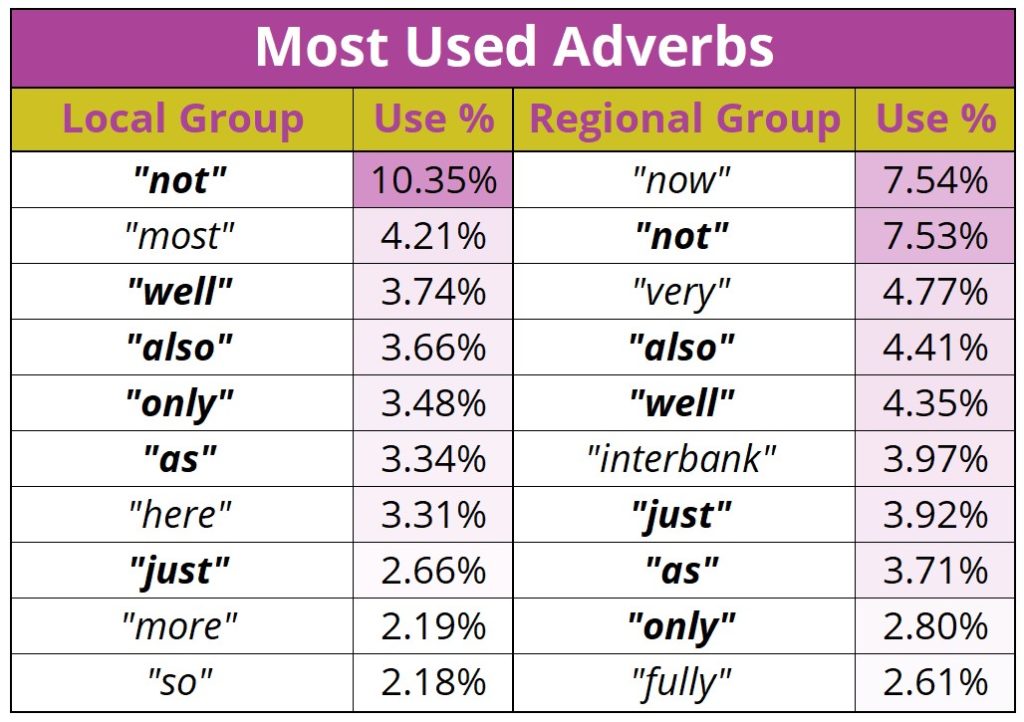

A shocking 10.35% of adverbs used in the local luxury corpora was “not” taking number one of all adverbs, while the same adverb came in second place of the regional group with 7.35%! This was coupled with an increase of inward focus language in social media and website content of the local luxury group as the charts show.

- At Consult Upgrade, we provide a complete set of solutions, analyses, insights, recommendations, contents, and training of your organisation to help you achieve your business and strategic targets. Whether it is a matter of survival, sustaining business, or even growth, Consult Upgrade is ready to partner you in your journey to success.

Click Here to Know More

*Bold words shared are common top 10 words between the two groups

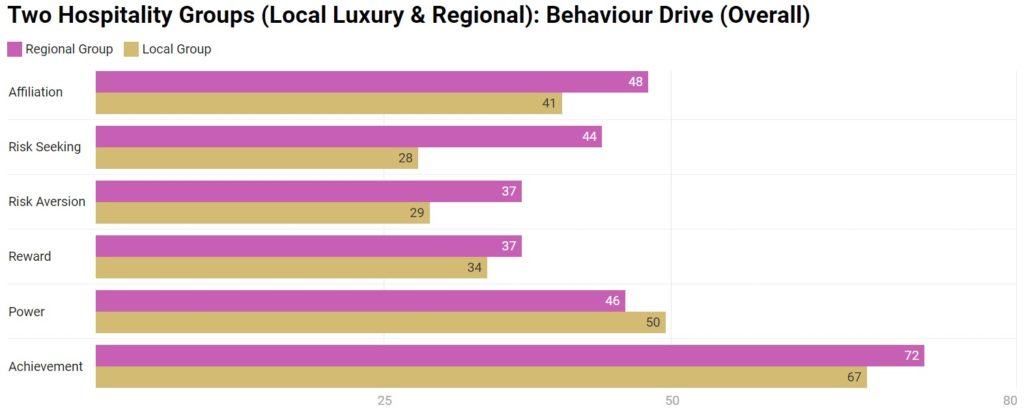

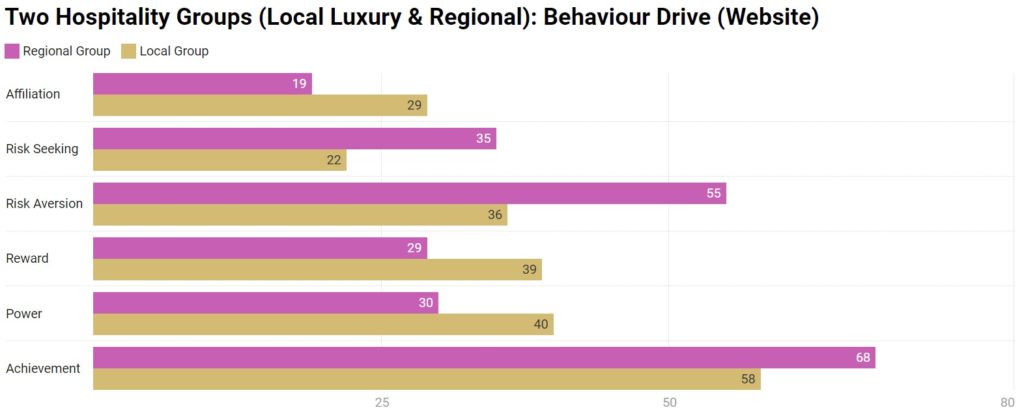

THE FINDINGS: Good news, no brain damage! Behaviour is OK

Consult Upgrade looked and analysed behaviour drives of both groups to explore whether there are other issues than sentiments, personality traits, and social dynamics. The news came comforting with no major issues reported. Albeit, there were some contrasting results between the social media content and the website content for both groups. With the regional group showing 35.85% more affiliation in social media content, the website content of the local luxury group managed to outweigh the regional ones by showing a smashing more affiliation, reward, with 52.63%, 34.48%, and 33.33% respectively.

What’s next for hotel sector content?

As the whole world is watching how the COVID-19 pandemic is unfolding, businesses in different sectors, and especially those in hospitality, were quite impacted by this heavy guest. Yet, majority of these business do not pay attention to the first contact made with their potential bookers: language! Therefore, adapting and manipulating language is key for survival by:

- Understanding that you are what you post as content

- Admitting that slashing room rates is not a guarantee of confirmed bookings

- Accommodating an ever-changing tourism landscape

- Claiming your clientele with focus on loyalty, rewards, and affiliation in your content

For full report and data contact us at Consult Upgrade or if you would like to have insights on your market, brand, marketing campaigns or your clients. At Consult Upgrade, we help you by:

– Collecting critical data about your content, clients, market, competition, and brand

– Delivering analyses, recommendations, and training on how to improve your campaigns, content, and brand outlook

– Auditing, designing, and developing new content to help you achieve your goals and targets

References:

Crouch, E. et al (2020, May 11). Breaking ground on a new era in lodging. Middle East – EN. https://www.bcg.com/en-mideast/publications/2020/understanding-consumer-behavior-in-hotel-industry-post-covid-19

Gasdia, M., & Jackson, A. (2020). Looking to the recovery of leisure travel demand. Deloitte Insights. https://www2.deloitte.com/us/en/insights/industry/retail-distribution/consumer-behavior-trends-state-of-the-consumer-tracker/consumer-sentiment-travel-tourism.html

Homsy, N. (2021). Repurposing of Hotel Assets. Grant Thornton | Grant Thornton UAE. https://www.grantthornton.ae/globalassets/1.-member-firms/uae/pdfs/repurposing-of-hotel-assets.pdf

Rizvi, M. (2021, April 10). COVID-19: UAE records world’s second-highest hotel occupancy rate in 2020. Khaleej Times. https://www.khaleejtimes.com/news/covid-19-uae-records-worlds-second-highest-hotel-occupancy-rate-in-2020

Comments are closed